Blockchain is a revolutionary, disruptive technology as the Internet was considered so, two decades ago. While dealing with the two use cases in the previous two chapters, we had seen what a tremendous change BCT brings into the business and customers. Today, there are over 2000 varieties of Cryptocurrencies exist in the open market. Dapps (Distributed Apps) have attracted business with a paradigm shift in business approach. Smart Contracts and Digital Assets have helped in the trustful business. Countless Blockchain platforms are available and these promote Blockchain solutions with plugins, protocols, new products, tokens, storage, cloud-based BCT, etc. Over 6500 projects are listed in Github is a measure of the interest and importance attached to BCT. Beyond all these, there are challenges to BCT.

The case of Cryptocurrencies

We have seen Cryptocurrencies are mined in a distributed permissionless network which is cyberspace. These are not Fiat Currency and also not in the purview of the legal system of a country. Generally, these are not regulated or monitored by the Governments. Many governments have banned the use and trading of Cryptocurrencies. The acceptance of these currencies is subjective. About 60+ countries like USA, Canada, Brazil, EU have legalized the Cryptocurrencies but the government does not regulate or control the exchange of these. Citizens are allowed to trade, purchase or exchange in CC at their own risk. CC is never a substitute for legal tender money. So these float in a standalone system which does not have government regulation. Although it is since 10 years that Bitcoin and clones are introduced, till date many countries do not have an explicit system that regulates, restricts or bans CC, but remains a grey area.

Another important observation is CC facilitates Darkweb, Silkroad, human trafficking, and underworld activities. This negative side is becoming a systemic issue. Some believe that CC can be used to circumvent capital controls, money laundering and illegal purchases, simply because it exists in a virtual world and enables a virtual or physical transaction. Few countries have given Value added tax exemption for CC, although not given the status of Fiat currency. If widely legalized and accepted, the entire banking system may become void and finance will have a new definition. The crypto-economy does not come under Fiscal policy of any government and hence does not add to the economy of the country.

Then why does CC exist is a question in the readers' mind. The convenience, no trusted third party, crossborder transactional features lure the public and private. Cash is the legal currency. However, Cash transactions have less record maintenance and transparency which is likely to favour illicit activity. We can not do away with physical cash. This argument is favourable of CC too.

From the user's perspective, care needs to be taken to handle virtual currency holdings. CC has crypto exchanges for trading and wallets for storing. The individual needs to safeguard his system against virus or attacks to ensure the availability of CC. Value of CC fluctuates daily and hence the asset value of CC holding also fluctuates.

In summary, the user of CC trusts his money to a complex system that he doesn't understand and he knows nothing about the complexity, that too in an environment where there is no legal recourse. Only if CC gets full recognition as a Fiat currency, citizens can get full power and potential of CC.

The legality of Digital assets transactions, Smart contracts

The business rules are embedded in the program code. Any change in business logic requires smart contract code to be changed. A flaw in the coding of a smart contract can be expensive. Smartcode is both the boon and the bane.

Both smart contracts and Digital assets transactions transact amongst the members of the network. If a regulatory body like a Central Bank, Insurance Regulator, Registrar of properties or IP attorney is not a member of the network, the transactions do not get registered with the law-enforcing authorities. Hence, the transaction remains private. It is ok to be private in many situations. For example, in supply chain mechanisms, authorship, certificate ownership, etc may have limited need for the involvement of regulatory authority.

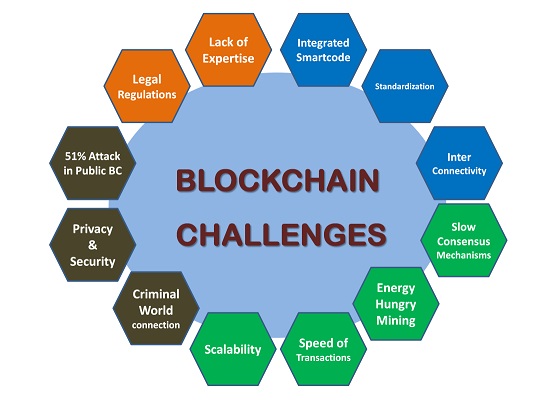

The Technological Challenges

Mining is process intensive requiring ultra-powerful hardware and hence the total cost of the Blockchain network is high both in terms of capital investment and running costs. The return on investments on individual processing nodes may be a factor in an organizational decision-making process while adopting BCT.

Blockchain operations are slow compared to traditional transaction processing. This is because of the consensus mechanism, additional layers of obfuscation and encryption. The delay is worse in public BC. The delay is affordable to a large extent in private BC enterprise solutions. These enterprise solutions also look at selective consensus mechanisms to improve performance.

Interconnectivity across applications and organizations is of prime importance for enterprises while considering BCT. Blockchain architectures are almost standardized with large solution providers like Ethereum, Hyperledger, R3, Ripple, Stellar, etc., and address this interconnectivity. However, the fact that Github is listed with 6500+ BC open-source projects shows that the technology is yet maturing and nonstandard solutions do prevail for various reasons.

Scalability is a major issue in terms of performance considerations and cost implications.

Security is a bit concern with 51% attack in public Blockchain eco structure i.e. if 51% of the nodes vote in favour in a consensus protocol, these nodes gain control of the full network, even wrong could become right. This is a rare scenario but is a threat from powerful hijackers.

In the case of Supply chain BCT adoption, the integration of ERP tools of the manufacturing unit into the BC is the hurdle. ERP is important for manufacturing. Traceability is important in Supply chain. Interconnectivity is falling short because of the lack of ERP tools operating over BCT. The next hurdle is the efforts required to convince the suppliers in on-boarding to the BC Network.

Business challenges

The principal challenge with BCT is the lack of awareness of technology and understanding of how it works, in sectors other than banking. It is too complex a technology and away from traditional processes and conventional thinking. It is being used for the protection of digital assets because of the perceived benefits.

Blockchain shifts the trust to Decentralized network members and away from a centralized legal authority. In many cases, this loss of control could be unsettling.

BC solution is about 80% business process change and 20% technology shift. This means, a radical step forward is required by Corporates but results in business value enhancement. BCT adoption will be beneficial only if shared pain points are understood and agreed by business collaborators.

Cost of BCT solution is high due to the customized solution, the need for specialized developers and complex integration efforts.

The customers have enjoyed instantaneous response with transaction processing systems. The slow response of BC hinders value creation for customers who expect instantaneous response probably with all the benefits of BC.

Regulatory constraints in financial and healthcare prevent the rollout of smart contracts. The business logic code incorporates the terms of the contract, but in case of litigation, its legality before the court is a question. Same is the case with digital assets transaction too. In these cases, the provenance characteristic is mutually agreed by the members of the BC network and is expected to eliminate the need for legal recourse.

Data breaches have been reported occasionally in CC platforms is a cause for less motivation on the higher investment required for BCT.

Then why Blockchain?

The internet is used for all kinds of crime, but if in 1998 we said "let's ban the internet because it's used for crime", the U.S. would have suffered.

The consensus mechanisms developed by Hyperledger, R3, Stellar, etc., reduce the time required to obtain consensus in the network to milliseconds from minutes. This is acceptable comparing the other tangible and intangible benefits that come along with BCT.

Standardization efforts continue. There are large, medium and consortium players working towards bringing in standardization. The consortium involves hundreds of public, private and government players channelizing their knowledge towards standardizing features and exploring new use-cases.

Organizations like IBM, Amazon, Microsoft work together with organizations in developing templates which will cost lower than customized solutions development. These templates along with plug and play features enable customization of solutions.

Regulatory support is improving from a few countries and certainly more countries to follow.